Loading...

Loading...

ISIP -FAQs

1. What is an ISIP?

An online platform for our New and Existing investors to start a Systematic Investment Plan (SIP) in our Mutual Fund Schemes without any paperwork, at your convenience using Laptop, Desktop, Mobile & Tab. All Applicants having online banking access with any of the listed banks as given in point below, can avail this seamless facility. Please note, that the details in the Statement of Account, will be reflected only after the first Instalment has been processed

2. How to invest in ISIP?

Investors need to access the transaction website with their (using their Login credentials) and follow the below steps:

Step1: Click on the “SIP” option available under Transact Online menu.

Step 2: Select the Folio Number under which you wish to invest.

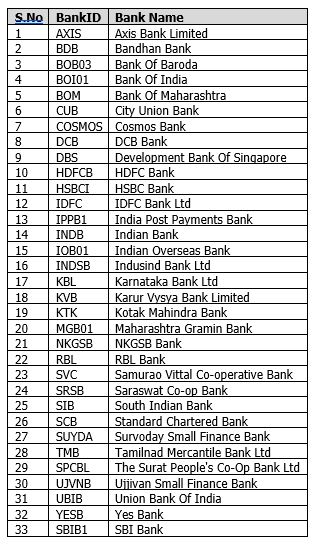

Step 3 : Select the Scheme, Plan, SIP Amount, SIP Date and the Duration/Period. It will show only the banks registered for i-SIP facility. Please ensure that the i-SIP, that you intend to start is from any of the below mentioned 32 banks.

Step 4 : Confirm Undertaking and Terms and conditions.

Step 5 : A Unique Registration Number (URN) will be generated for the intended registration.

Step 6 : The same URN has to be listed/registered with your bank on or before the expiry date of URN.

3. What is URN?

Unique Registration Number (URN) is generated for every i-SIP you register with us which comes with the validity of 10 calendar days from the date it is generated on our website. You have to register this number with your bank under “Utility BillPay” option.

4. How to register a URN at bank’s site?

Just the way you register any of your utility bills with your bank for online payment, such as Mobile, Electricity, MTNL, Gas, etc., you can register the URN with your bank for i-SIP.

You have to login to your bank’s website and register Trust Mutual Fund as a biller under BillPay option along with the exact URN allotted to you, by selecting our name and registering it as a biller. At the time of registration, you will be asked for the mode of payment depending upon the bank you are registering with.

5. What are the reasons for a registration not being successful at the bank’s end/Mutual Fund’s end?

i) If you register an incorrect URN at bank’s end, the same will be rejected at bank’s end.

ii) If you register the URN at your bank beyond the stipulated time limit determined by the AMC, the URN gets expired at the AMC’s end. Generally, the URN will expire in 10 Calendar Days

6. What are the modes of payment available at bank’s end for ISIP?

Below are the two types of payment options available at bank’s end for i-SIP

i. Auto-pay mode: If you opt for this mode, the SIP amount will be debited automatically on the due date provided your account has sufficient balance.

ii. View and pay mode: If you opt for this mode, you have to login in and schedule the payments failing which the bill gets expired and this is termed as Failure due to funds not received from your bank.

It is recommended to select Auto-Pay mode for continuity of SIP and also to do away with the manual intervention of every month authorizations, with the other option.

7. Will TRUSTMF represent the failed / unsuccessful transaction?

No. At TRUST Mutual Fund, there is no policy to represent the failed/unsuccessful transaction and that the units for the failed instalment will not be re-instated.

8. Can I keep track of my paid/missed bills?

Yes. You can track your bills in the Bill History option provided by your bank.

9. How can I discontinue/ cancel my ISIP?

At any point in time, you can discontinue the registration at bank’s end by deleting the bill. The deletion information will be passed to us while providing the reverse transaction feed.

10. Can I register ISIP through any Bank?